Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer. This works out to 24K per year post-tax or roughly 50K per year pre-tax presuming US and a 50 tax bracket.

How Much Should You Really Spend On A Car

It will not love you it is very unlikely to grow in value and if having it makes other people think more highly of you it does not speak well of them nor your need to impress them.

. The personal finance answer is likely no. How much car can I afford 70K salary. How much should you make to buy a 70K car.

Home buying with a 70K salary. To afford a 100000 car its probable you need to make 300000 a year conservatively after taxes. Car Loan Interest Rate.

According to Alexa Pineda Properatis credit specialist the monthly payments of a housing loan cannot exceed 30 of the holders income. Some of the most common options are the Nissan Altima Ford Mustang Chevrolet Camaro or Toyota Camry. These are some of the cars you can afford if you earn roughly.

The Best Cars for Around 150 Per Month. I used the following assumptions 5 year loan on a 70K car would be around 1500 per month with a reasonable interest rate. If your monthly car payment is 1509 we calculate that you will need 1000 for car insurance gas car maintenance and repairs for a total budget of 2500month.

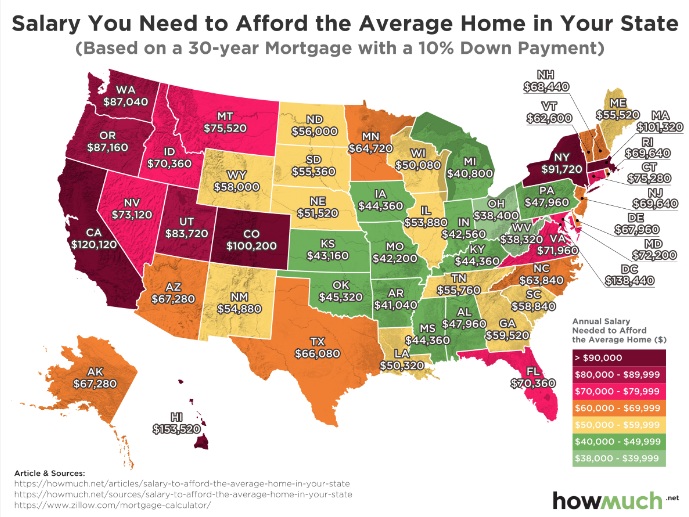

Lenders want your principal interest taxes and insurance referred to as PITI to be 28 percent or less of your gross monthly income. If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances. On a 50000 salary it is recommended you dont spend more than 5000 10 on a car.

Ad Best Personal Loans of 2022. I used the following assumptions 5 year loan on a 70K car would be around 1500 per month with a reasonable interest rate. Get invoice pricing for free - guaranteed.

Thats why cars costing up to 30000 can be purchased with an annual income of 60000. The sales tax is usually added to your car loan increasing the amount you owe. Ive decided a 2010-13 accord around 10-12k once Ive the cash should be good idea.

The calculator here will help you find the amount you can spend on a car based on your salary and expenses. Best Loans of 2020. Ad We have access to the best insider pricing deals.

Dave Ramsey recommends spending no more than half your gross annual income 50k on a new car. In which you pay the balance of principal and interest. Low APR from 399.

That is if you earn COP 1000000 a month you can not pay more than COP 300000 in monthly payments. When you can remove 50k from your pre-tax income without really caring. In September 2019 the average amount financed for a new vehicle was 32928 according to Edmunds data.

If you want a 70000 car and have the basics covered- 6 mont. Insurance presuming you should. The price of a car isnt the only thing that determines how much car you can afford.

The wiser use of your personal finances would likely be more along the lines of a 2 year old Accord. The interest rate on your car loan also affects your monthly payment. Unfortunately this amount isnt negotiable.

Perhaps the question ought to be should I buy a 30k car. Well assume he has solid credit. You just have to pay it.

Thats a 120000 to 150000 mortgage at 60000. Answer 1 of 11. Of course these figures are merely recommendations and personal preference has to be taken into account but we have used them to demonstrate some of the best cars you can afford to finance for your salary.

Use your monthly budget to estimate your maximum car price with our car affordability calculator. Down payment you are willing to pay in at the time of vehicle purchase. Last Updated on April 28 2021 by.

This is the amount you are willing to pay per month as EMI of the car. No Credit Harm to Apply. When you can remove 50k from your pre-tax income without really caring.

Lets say John bought a new Honda Pilot for that amount. The usual rule of thumb is that you can afford a mortgage two to 25 times your annual income. A car is a depreciating asset.

How much car can I afford on a 50000 salary. Some people believe that it is possible to spend up to 50 of annual income on a car. Dec 31 2021 5 year loan on a 70K car would be around 1500 per month with a reasonable interest rate.

However the cost of a car really includes purchase price opportunity cost of investments or loan interest. Take a look at what you can afford below. Op 6 yr.

The car loan amount you avail will be the actual car value minus the down payment. Insurance presuming you should be in a 70k car will be another 250 a month. A chevron arrow pointing down.

How much car can I afford on a 70K salaryAnswered By.

Question How Much Car Can I Afford 70k Salary Make Money Internet

I Make 70k A Year What Car Can I Afford The Money Casa

How Much Car Can I Afford 70k Salary Outright Digital Media

I Make 70k A Year What Car Can I Afford The Money Casa

What House Can I Afford On 70k A Year Deals 55 Off Edetaria Com

What Kind Of House Can I Afford Making 70k Clearance 56 Off Www Simbolics Cat

0 comments

Post a Comment